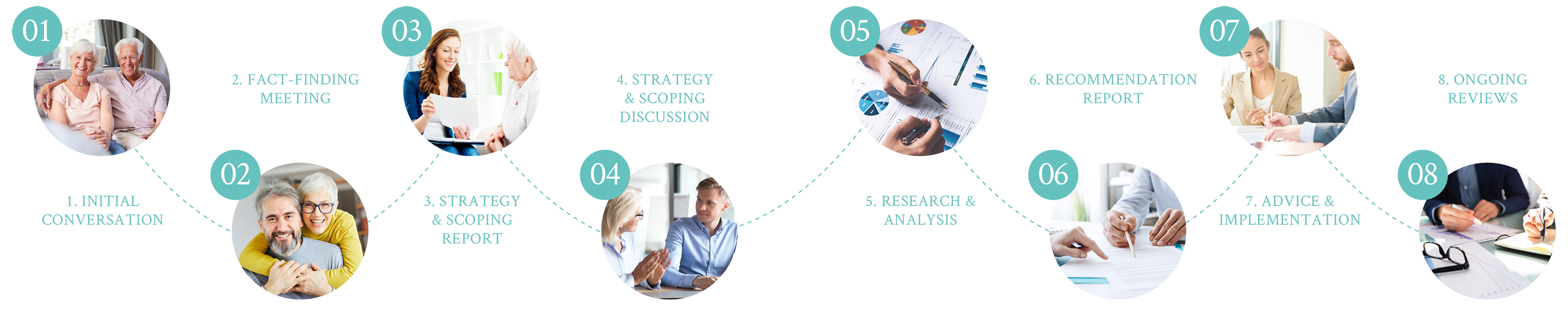

The eight steps explained

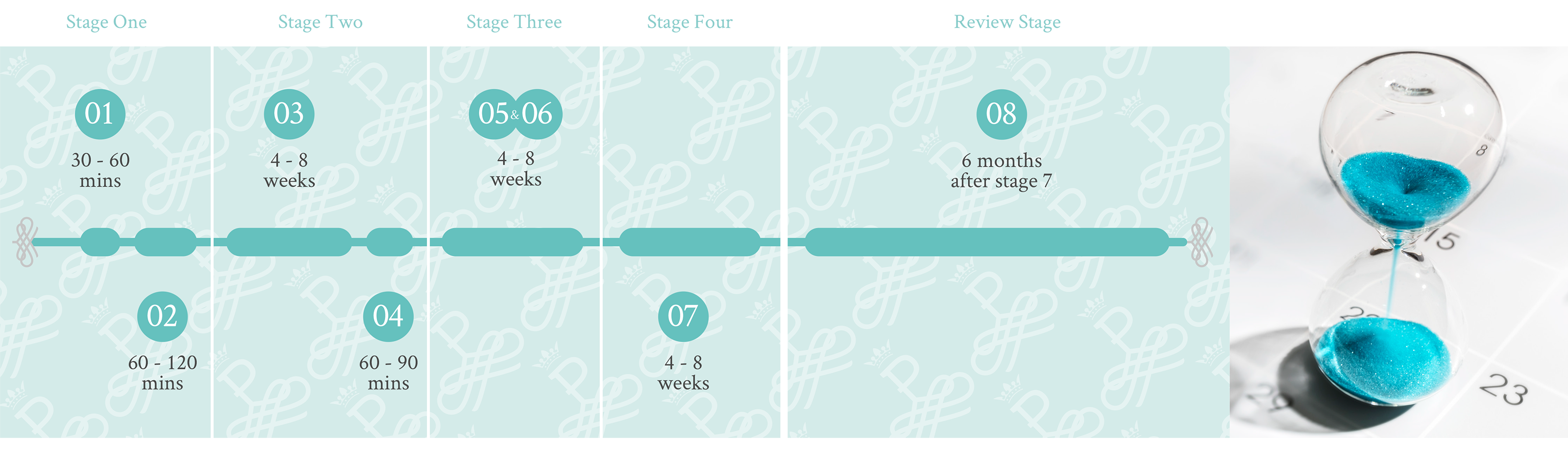

The initial conversation is one of great importance in the advice cycle. It allows us to get to know each other and uncover what is important to you.

The conversation can take place in person, or over the telephone, whichever option suits you. As well as us finding out about you, we want you to take this conversation to get to know us and our services, making sure that we fit with your needs.

During this conversation, we will be collecting basic information to help us assess if our services will be right for you.

The next step of the advice cycle is a Fact-Finding meeting. Unlike the initial conversation, we recommend that this meeting is held in person. We use the time to ask questions that are designed to make you think about what you want to achieve, allowing us to set goals.

It is essential that you are prepared to discuss all aspects of your financial circumstances, as being open and honest helps us to establish your objectives and values.

As with the initial conversation, there is no charge for the discovery meeting. It is only if you proceed to the next stage that charges will begin.

Before proceeding we will provide full details of the services that we offer which we deem to be appropriate for you, together with an estimate of the fees you would be required to pay.

The purpose of conducting a Strategy and Scoping Report is to ensure that we have fully understood your objectives, priorities, needs and aspirations for the short, medium and long term.

We explore the nine heads of financial planning to include:-

• Goals/Aspirations/Values

• Balance Sheet (assets and liabilities)

• Budgeting (income and outgoings)

• Savings

• Investments

• Pensions

• Protection

• Taxes

• Estate Planning

Dependent on your circumstances we can provide a focused Strategy and Scoping Report on say one aspect of your financial affairs. This may appeal, for example to a person who has a range of pensions and wishes them to be consolidated. In this situation, an initial analysis by way of the Strategy and Scoping Report will provide valuable information to help in our decision on whether consolidation of all the existing arrangements is appropriate and indeed what any new planning might incorporate.

The Strategy and Scoping Report will provide you with headline solutions to your needs and identify other areas that you may not have considered. There is often no one single correct solution to creating a financial plan which is why we take the time with you to provide an analysis of your existing position and assist in prioritising, segregating and putting in place structures and solutions to address your needs.

Once we have completed our review and developed a Strategy and Scoping Report, we will arrange another meeting with you to present our findings and provide you with our Strategy and Scoping Report.

This report will give you a detailed insight into your existing arrangements and the options available to you in an attempt to achieve your goals.

It is also possible that we highlight areas where, given your current circumstances, your goals may not be realistic. However, this honest and open discussion gives you the opportunity to ask questions and time to reassess or make amendments to financial planning to make your goals achievable.

A typical initial review report discussion will take around 1-1.5 hours, and should you wish to implement any of the options provided, you will move onto our research and analysis part of the advice cycle.

Once you have an understanding of the planning that is needed to achieve your goals, it’s time for us to analyse the financial products that you currently have to assess if these are appropriate. Our understanding of your needs may be as a result of Steps 1 & 2 or a more comprehensive Strategy and Scoping Report, Steps 1,2,3, and 4.

As independent advisers, we have no bias to any specific product or provider and, therefore, will only recommend that a product is changed or a new one established if this is needed to achieve your objectives. This work is completed by us behind the scenes, and it can take some time to collate all the information needed for us to be able to provide you with the most appropriate solution.

On completion of our research and analysis, we will issue you with a recommendation report which will detail the reasons for our recommendations.

This report will be issued in advance of our presentation meeting, to ensure that you have sufficient time to read through it and make a list of any questions that you have.

This report will confirm our payable fees should you wish to proceed with our recommendations.

At this meeting, we will present to you our recommendations as detailed in the report, explain how we believe that these will enable you to achieve your goals, and answer any questions that you might have.

Once we are confident that you understand our advice, should you wish to proceed we will help you to complete all the necessary paperwork to move this forward and re-confirm our fees as detailed in the recommendation report.

We will also take this opportunity to confirm our ongoing review service.

To ensure your financial plans keep on track we recommend reviewing these regularly, at least annually although more frequent reviews might be required depending on your circumstances.

We will take this opportunity to ensure that you are happy with the service that we have provided so far, and to establish a review pattern which meets your requirement moving forwards and enables us to ensure by keeping your financial circumstances under regular review, that these continue to meet your requirements and are moving you closer to your financial & personal goals. This also allows us to be proactive, as you may not be aware of changes in tax or regulation that might impact you, we will discuss these with you and support you to make any necessary changes.

This service enables us to create meaningful long-lasting relationships with our clients, giving you peace of mind that you are being looked after.

* ££ = When fees are charged